Person-Centered Financial Education

Person-Centered Financial Education© (PCFE) is an educational approach that views personal finances and economics as an integral part of the whole person.

Person-Centered Financial Education© incorporates the tools of basic finance and economics into an understanding of a person’s psychological, emotional and cultural relationship with money.

Learn MoreFind out all the important updates

We keep our ears to the ground and finger on the pulse at FHI, bringing you the latest information on all things financial health.

Why “Financial Health”?

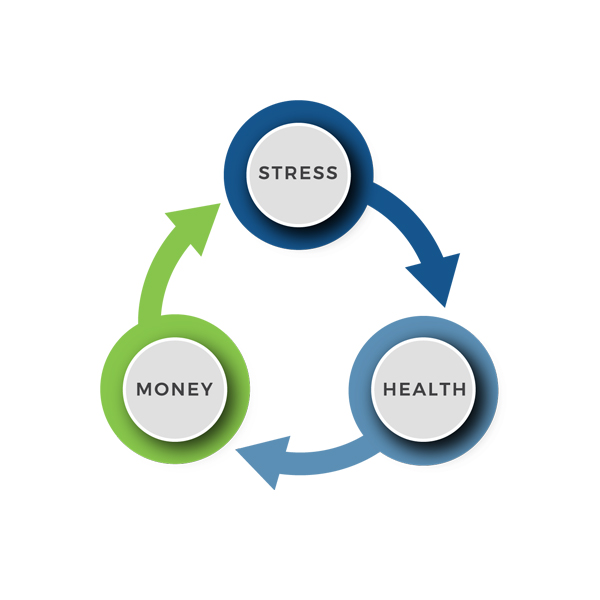

Money is one of the most frequently reported causes of stress. Stress is one of the most influential determinants of health. Poor health is one of the largest burdens on personal finances. Learn more about how we have defined Financial Health, in line with the WHO’s definition of health.

Addressing the Hopelessness and Helplessness of Economic Stress

Financial and economic stress has numerous and significant effects on mental and physical health.

Developing Resilience in the Face of Economic Stress

Addressing this issue requires comprehensive support systems, including access to mental health services, resource navigation, and social support networks along with effective person-centered financial education to help individuals navigate the challenges posed by financial and economic stress.

Financial education needs to be for everyone, yet it should not assume everyone has the same goals, values, and knowledge. It needs to move beyond neo-classical economics and embrace new information from the fields of neuroscience, behavioral economics, psychology and public health.

We need your help.

FHI has spent two decades helping people who are experiencing economic stress by challenging the traditional mindset around “Financial Literacy.” As we continue to redefine the possibilities of financial education, we need people who believe in what we are doing to help us by getting involved.

Support UsTraining Program Design

FHI is frequently asked to help design programs for other organizations – here’s how we can help you if you’re looking to design your own training program

Training System Design & Consulting

FHI develops, implements and manages large scale training projects that span across regions, states, multiple agencies and/or departments

Comprehensive Course and Program Design

FHI develops, implements and manages entire training programs or individual courses for organizations (Includes Organizational and Professional Development programs)

Course and Program Delivery

FHI develops, implements and delivers training programs specifically developed for clients and customers of human services and economic development